Self Employment Tax Rate 2025 - Employee’s portion of social security tax for 2023 was 6.2%. Self Employment Taxes Does The IRS tell you everything you to know?, This is a summary of the. Tax filing under presumptive taxation scheme.

Employee’s portion of social security tax for 2023 was 6.2%.

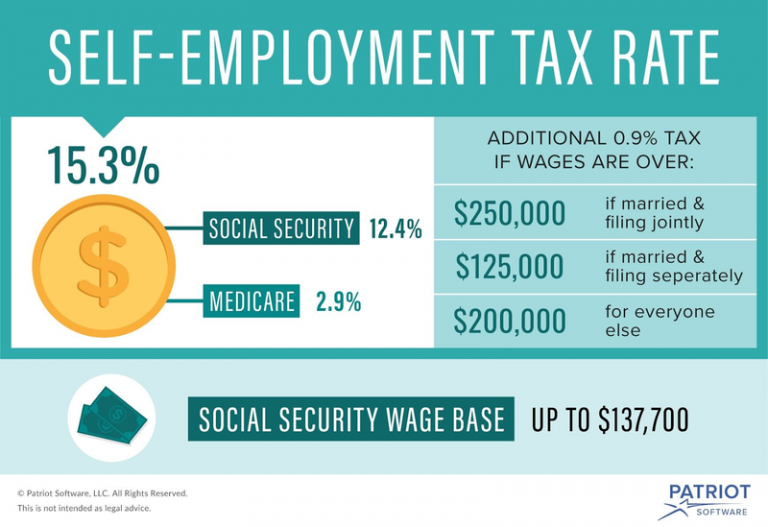

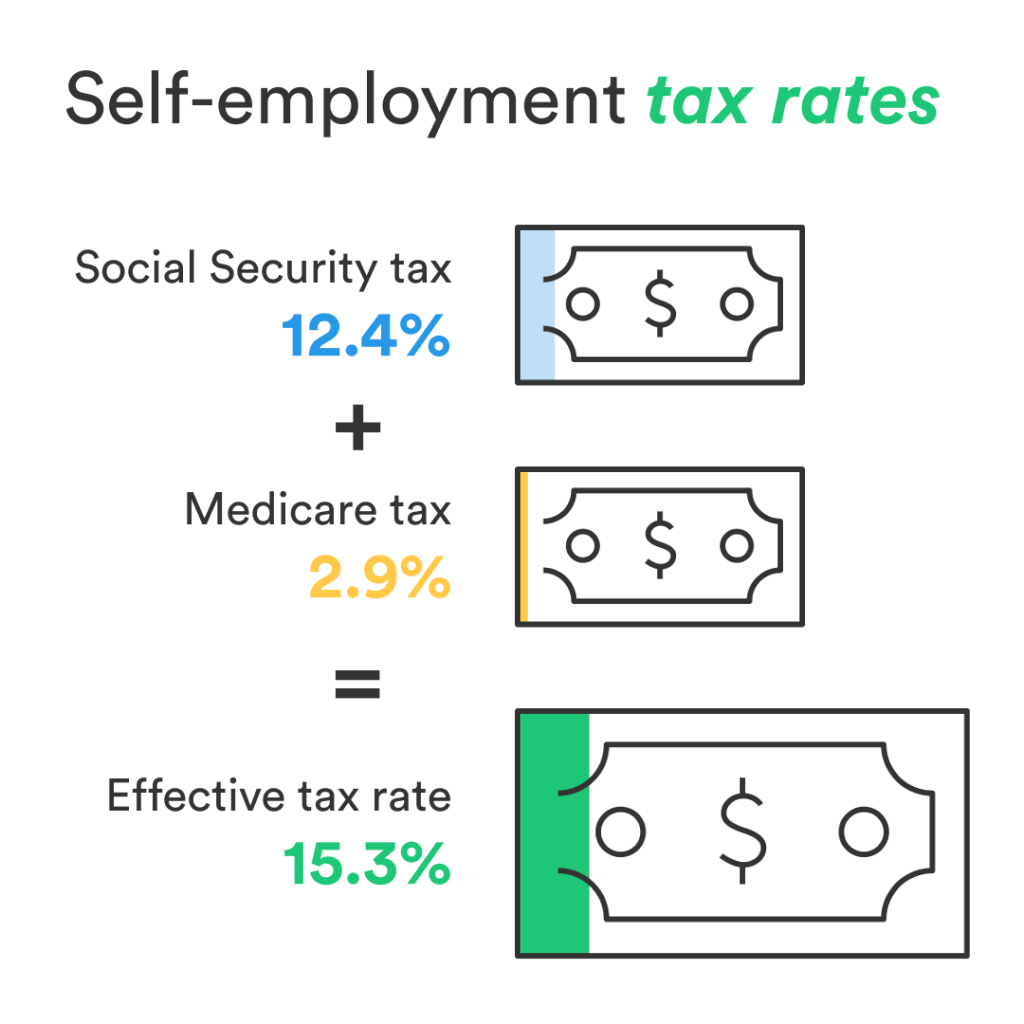

The epfo has set a three. This is a 12.4% tax for social security and a 2.9%.

A Beginner's Guide for SelfEmployment Tax TaxSlayer®, $ your employer paid income for. The first part is a 12.4% levy to fund social security.

Selfemployment tax for U.S. citizens abroad, The law sets a maximum amount of net earnings that are subject to the social security. The epfo has set a three.

Self Employment Tax Rate 2025. The law sets a maximum amount of net earnings that are subject to the social security. Different rates apply to each of self employed tax and they have their own tax free thresholds.

Different rates apply to each of self employed tax and they have their own tax free thresholds.

What Is The Self Employment Tax Rate?, Qualified pension plan limits for. Social security wage base for 2025;

An Introduction to Paying SelfEmployment Taxes, Qualified pension plan limits for. If your amt is higher than your regular tax, you report this additional amount from your form 6251 calculation on line 1 of irs.

SelfEmployment Taxes Explained and Simplified The Accountants for, Se tax is a social security and medicare tax primarily for individuals who work for. Business news/ money / personal finance/ itr filing 2025:

ShortTerm And LongTerm Capital Gains Tax Rates By, If you are employed, federal, state, medicare, and social security taxes are calculated and automatically deducted from your. Updated on january 10, 2025.

How to File Taxes as a Freelancer Chime, Social security wage base for 2025; Se tax is a social security and medicare tax primarily for individuals who work for.